CMM 2023-09-10

Minutes of Meeting for Worship with Attention to Business

Concord (NH) Monthly Meeting of

the Religious Society of Friends

10th of Ninth Month 2023

Seventeen Friends gathered for meeting for worship to attend to business, in person and by Zoom. We opened with a brief period of quiet Worship.

Minutes of Eighth month 2023 were approved as posted on our website.

09.01 Correction to Seventh Month Minutes: A correction needs to be made to minute 07.06 which appoints an ad hoc Fundraising Committee. It was headed “Childcare Planning Fundraising Committee”. The heading is incorrect and the words “Childcare Planning” will be removed from the heading. Friends approved making this change.

09.02 Nominating Committee reported on replacing the interim presiding clerk with a new clerk for the rest of the year. They are recommending that Richard K and Ruth H share the responsibility. Nominating committee expects that the two co-clerks will address how they coordinate the work involved. The clerks will report at Meeting for worship with attention to business on their plan for their communication with each other and the rest of the Meeting around the clerks’ responsibilities.

09.03 Appreciation for Heidi’s Clerkship: Friends expressed our deep appreciation to our recent presiding clerk, Heidi B for all of the leadership she provided before she needed to move for a new job.

09.04 Fire Safety & Heating System: The ad hoc committee for fire safety and heating system replacement gave an update on the project to bring our Meetinghouse into compliance with fire codes. We are now in compliance with Canterbury fire code. An interim financial report on the project was provided and is attached. The ad hoc fundraising committee reported on where things stand on getting funds to replace the short-term loans that allowed the project to move forward. They will be communicating with the rest of Meeting about the need for additional contributions above the grants and contributions that have already been received or will be received. Grant applications for $18,500 are pending. The overall goal for grants and contributions is $30,700.

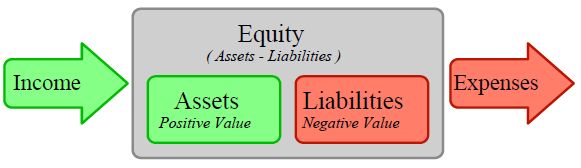

09.05 Finance Committee reported on our current fiscal status as we operate on a continuation of the prior fiscal year budget pending the finalization of work on the heating system replacement. Total income for the first 3 months of the fiscal year was $9,198.86. Total expense for the period was $5,963.83 for an increase in our funds of $3,235.03. Changes to the balance sheet were also explained, including a provisional addition of contributions already received that are earmarked for the new heating system.

| Total Income: | $9,198.86 | |

|---|---|---|

| Total Expenses: | $5,963.83 | |

| Net Income: | $3,235.03 |

09.06 Funds for Kenya: YRE reported on a proposal to use some of the extra proceeds of the yard sale that we held recently that raised far more than our $900 obligation to the Kenya Rising program for this year and $900 again next year. Proposals included increasing the amount given to Kenya Rising or giving $700 to the efforts of F.U.M. to rebuild the Lindi School in a Nairobi slum which had burned down. Friends approved that latter use of the funds.

In preparation for our next item of business, Friends responded to a query from the interim clerk: What has been your experience of worship these past months while our mask optional policy has been in place?

09.07 Masking in Meeting Guidance: Ministry and Counsel Committee recommended that masks remain optional in the worship space unless the CDC data tracker shows red (risk level based on local hospital admissions for COVID19) for Merrimack County [https://covid.cdc.gov/covid-data-tracker/#maps_new-admissions-rate-county]. Friends decided that we should include all counties in NH and make this apply to the entire Meetinghouse during all Meeting activities. The Presiding Clerk (or person designated by them) will check the CDC website on a regular basis and make an effort to get the word out before worship if masks will be required in the Meetinghouse.

We closed with a brief period of quiet worship, purposing to meet again on the second First Day of Tenth month.

| Submitted by, | Accepted as the Approved Record, | |

| /s/ Jennifer Smith, Recording Clerk | /s/ Elizabeth Meyer, Presiding Clerk |

| Concord Monthly Meeting Statement of Operations | 2023-06-01 – 2023-09-06 | Budget – FY 2023-24 | Budget Remaining | % of Budget Raised |

|---|---|---|---|---|

| Income | ||||

| Contributions | $8,516 | $27,400 | $18,884 | 31% |

| Grants | $0 | $0 | $0 | 0% |

| Interest Income | $33 | $810 | $777 | 4% |

| Rental Income | $650 | $900 | $250 | 72% |

| Solar Roof Lease | $0 | $240 | $0 | 0% |

| Total Income | $9,199 | $29,350 | $20,151 | 31% |

| Expenses | % of Budget Spent | |||

| Program | ||||

| Finance Committee | $0 | $30 | $30 | 0% |

| Hospitality | $45 | $100 | $55 | 46% |

| Library | $0 | $140 | $140 | 0% |

| Ministry & Counsel | $0 | $400 | $400 | 0% |

| Outreach Committee | $0 | $175 | $175 | 0% |

| Peace, Social & Earthcare Concerns | $0 | $150 | $150 | 0% |

| Right Relations | $0 | $400 | $400 | 0% |

| Website Expense | $0 | $1,000 | $1,000 | 0% |

| Youth & Religious Education | $50 | $300 | $250 | 16% |

| Total Program | $94 | $2,695 | $2,601 | 4% |

| Property | ||||

| Data Usage | $296 | $960 | $664 | 31% |

| Debt Service | $952 | $3,805 | $2,853 | 25% |

| Depreciation | $953 | $3,810 | $2,858 | 25% |

| Donation in Lieu of Taxes | $0 | $500 | $500 | 0% |

| Electricity | $250 | $1,000 | $750 | 25% |

| Grounds | $0 | $100 | $100 | 0% |

| Insurance | $745 | $2,890 | $2,145 | 26% |

| Maintenance | $194 | $1,180 | $986 | 17% |

| Snow Removal | $0 | $1,600 | $1,600 | 0% |

| Supplies - Bldg. & Maintenance | $22 | $250 | $228 | 9% |

| Wood Pellets | $215 | $1,200 | $985 | 18% |

| Total Property | $3,626 | $17,295 | $14,741 | 15% |

| Support | ||||

| AFSC | $450 | $1,640 | $1,190 | 27% |

| Dover Quarterly Meeting | $0 | $10 | $10 | 0% |

| FCNL | $0 | $157 | $157 | 0% |

| Friends Camp | $0 | $314 | $314 | 0% |

| FWCC | $0 | $68 | $68 | 0% |

| Interfaith Council | $0 | $50 | $50 | 0% |

| NEYM - Equalization Fund | $0 | $314 | $314 | 0% |

| NEYM - General Fund | $1,786 | $6,491 | $4,705 | 28% |

| NH Council of Churches | $0 | $75 | $75 | 0% |

| Woolman Hill | $0 | $241 | $241 | 0% |

| Miscellaneous Expenses | – | – | – | – |

| Total Support | $2,236 | $9,360 | $7,124 | 0% |

| Landscaping | $8 | – | – | – |

| Total Expense | $5,964 | $29,350 | $23,386 | 9% |

| Net Income | $3,235 |

NB. The Income & Expenses Sheet was created with two decimal points, which were removed for readability, the cents being unimportant to the overall understanding. This can have the effect of throwing off any given sum by a dollar due to compounded rounding. — Prepared by Greg Heath and Chris Haigh.

| Concord Monthly Meeting Balance Sheet | 9th Month 6, 2023 | ||

|---|---|---|---|

| ASSETS | |||

| Current Assets | |||

| Checking/Savings | |||

| Checking MCSB | $25,086 | ||

| Money Market MCSB | $113 | ||

| Savings Granite State Cr Union | $10 | ||

| Total Checking/Savings | $25,208 | ||

| Accounts Receivable | |||

| Accounts Receivable | $0 | ||

| Total Accounts Receivable | $0 | ||

| Other Current Assets | |||

| Prepaid Electricity | $4,752 | ||

| Prepaid Insurance | $993 | ||

| Total Other Current Assets | $7,745 | ||

| Total Current Assets | $30,954 | ||

| Fixed Assets | |||

| Building | $446,730 | ||

| Equipment | $61,487 | ||

| Less Accumulated Depreciation | -$34,025 | ||

| Land (including new lot) | $144,400 | ||

| Total Fixed Assets | $618,592 | ||

| Other Assets | |||

| Granite State Credit Union CD | $3,067 | ||

| Total NH Community Loan Fund | $24,869 | ||

| Total Other Assets | $27,937 | ||

| TOTAL ASSETS | $677,483 | ||

| LIABILITIES & EQUITY | |||

| Liabilities | |||

| Current Liabilities | |||

| Loan - Heating - Fire Safety | $44,000 | ||

| Total Current Liabilities | $44,000 | ||

| Long-term Liabilities | |||

| Mortgage Loan | $6,340 | ||

| Total Long-term Liabilities | $6,340 | ||

| Total Liabilities | $50,340 | ||

| Equity | |||

| General Fund Balance | |||

| Fire Safety Improvements | $6,500 | ||

| Land & Building Fund - Other | $610,855 | ||

| General Fund Balance – Other | $561 | ||

| Total General Fund Balance | $617,916 | ||

| Temp. Restricted Net Assets | |||

| Donor Restricted Funds | |||

| Asylum Seekers Support Fund (ASSF) | $37 | ||

| Kakamega Family Support Fund | $2,518 | ||

| Mindful Mortality | $975 | ||

| Social Justice Fund | $303 | ||

| Solar Grant Fund | $1,209 | ||

| Total Donor Restricted Funds | $5,042 | ||

| Meeting Temp. Restricted Funds | |||

| Friendly Assistance Fund | $950 | ||

| Total Meeting Temp. Restricted Funds | $950 | ||

| Total Temp. Restricted Net Assets | $5,992 | ||

| Net Income | $3,235 | ||

| Total Equity | $627,143 | ||

| TOTAL LIABILITIES & EQUITY | $677,483 |

Fire Safety and Geothermal Heating System Report

| Expense Item | Actuals | Budget | Upddated Amount | +/- | ||

|---|---|---|---|---|---|---|

| Source of Funds | ||||||

| Capital Campaign | $6,500 | 3 | $20,000 | $20,000 | - | |

| Federal Subsidy (30% of geothermal) | 4 | $17,490 | $15,383 | $2,108 | ||

| Sale of Pellets * | $389 | 5 | $500 | $389 | $111 | |

| Sale of Other Items | $300 | 6 | $300 | ($300) | ||

| Replacement Reserve | $20,000 | 7 | $20,000 | $20,000 | - | |

| Total Source of Funds | $27,189 | $57,990 | $56,072 | $2,919 | ||

| * Sandbags & Dolly purchased for selling pellets | ||||||

| Expense | ||||||

| Fire Alarm System | $3,731 | $11,175 | $12,437 | ($1,262) | ||

| Code Compliance Consultant | $2,118 | $1,500 | $2,118 | ($618) | ||

| Emergency Lighting/Exit Signs | $195 | $197 | $195 | $2 | ||

| Electrician | $333 | $1,000 | $244 | $756 | ||

| Legal | - | $259 | - | $259 | ||

| Fire Department Key Entry | $507 | $500 | $507 | ($7) | ||

| Geothermal Exterior GAP Mtn | $26,050 | $24,950 | $26,050 | ($1,100) | ||

| Geothermal Interior Ultra Geo | $20,180 | $33,350 | $25,225 | $8,125 | ||

| Interest | - | - | - | - | ||

| Contingency | - | $369 | - | $369 | ||

| Total Expense | $22,253 | $73,300 | $65,566 | 8 | $7,734 | |

| Net | ($25,925) | ($15,310) | ($10,705) | 9 |

1 Funds expended are added to our asset base of the Building & Equipment lines on the Balance Sheet

2 Note significant funds expended since the end of August.

3 Capital Funds Contributed are provisionally posted on the Balance Sheet so they do not skew our regular Statement of Operations. Fundraisers have yet to officially kick off the campaign.

4 Federal subsidy not available until after the end of our fiscal year next May

5 Net of sand bags and dolly purchased for selling pellets, pellets $450, and dolly sold $25. This offsets our prepaid expense of

6 Boiler and pellet bin sold. Fire sale pricing to be shared in Meeting for Business.

7 Accounting for Replacement Reserve now treated as Accumulated Depreciation on the Balance Sheet.

8 Total of Funds Expended in Updated Amount column is now known and set, $6,524 lower than budget with the exception of interest on our short term borrowing.

9 Net of ($10,705) represents what we will need to fund through long term borrowing if we meet our capital campaign goal of $20,000 from members and friends of the Meeting. The fund raisers are also applying for grants which they hope will allow us to reduce our long term borrowing.